EPD K1 Beyond the Basics: Mastering the Art of Enhanced Performance

The world of finance and investment is constantly evolving, and staying ahead of the curve requires a deep understanding of the tools and strategies available. One such tool, gaining significant traction for its ability to optimize portfolio performance, is the EPD K1. While the fundamentals of EPD K1 are widely known, truly leveraging its power requires delving beyond the basics. This article aims to provide a comprehensive guide, exploring advanced concepts, practical applications, and strategic insights to help you maximize the potential of your EPD K1 analysis.

What is EPD K1 and Why Does it Matter? (Review)

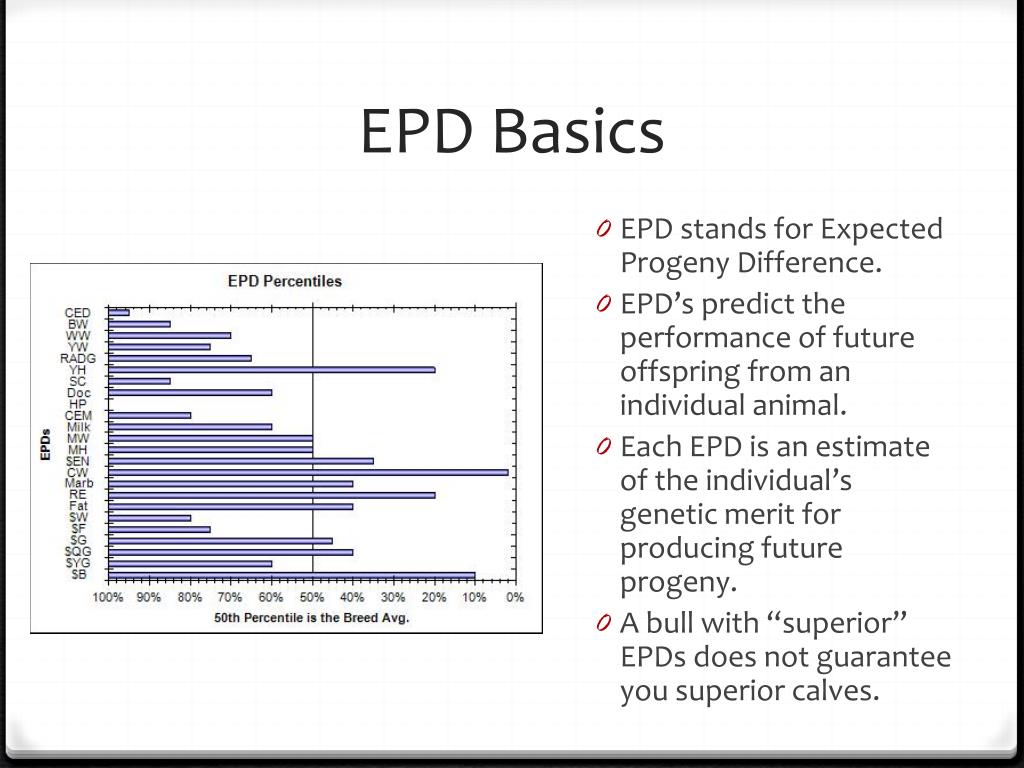

Before we dive deeper, let’s briefly recap the fundamentals. EPD K1 refers to the Economic Profit Driver (EPD) and its application to Key Performance Indicators (KPIs). Essentially, it’s a framework for evaluating the profitability of investments, particularly within the context of private equity and venture capital. It moves beyond traditional metrics like IRR (Internal Rate of Return) and focuses on generating a more holistic view of a company’s financial health.

- Key Benefits of Using EPD K1:

- Provides a clearer picture of true economic value creation.

- Helps identify the key drivers of profitability.

- Facilitates more informed investment decisions.

- Enables more accurate performance benchmarking.

- Supports proactive management strategies.

Unpacking the Advanced Concepts of EPD K1

Moving beyond the introductory level, understanding advanced concepts is crucial for truly leveraging EPD K1’s power. This involves a deeper understanding of its components and how they interact.

1. Dissecting the EPD Formula and its Sensitivity Analysis

The core EPD formula typically involves calculating the difference between a company’s net operating profit after tax (NOPAT) and its capital charge. To go beyond the basics, you need to:

- Understand the nuances of calculating NOPAT: This requires a thorough understanding of accounting adjustments, including those related to depreciation, amortization, and deferred tax liabilities.

- Master the capital charge calculation: This involves determining the weighted average cost of capital (WACC) and understanding how it impacts the overall economic profit.

- Conduct Sensitivity Analysis: This allows you to assess how changes in key variables (e.g., revenue growth, operating margins, WACC) impact the EPD. This is vital for understanding the risks and opportunities associated with an investment.

2. Integrating EPD K1 with Strategic Decision-Making

EPD K1 isn’t just about crunching numbers; it’s about informing strategic decisions. This requires a deeper understanding of:

- Identifying Key Value Drivers: Once you’ve calculated the EPD, the focus shifts to identifying the specific factors that are driving (or hindering) economic profit. This often involves analyzing KPIs related to sales, costs, and capital efficiency.

- Performance Benchmarking: Comparing a company’s EPD and its underlying drivers against industry peers or historical data allows for a more robust evaluation of performance.

- Scenario Planning: Using EPD K1 to model different future scenarios (e.g., a recession, a new product launch) enables proactive risk management and strategic planning.

3. Leveraging EPD K1 for Portfolio Optimization

In the context of a portfolio, EPD K1 can be a powerful tool for optimizing investment allocation and improving overall returns.

- Prioritizing Investments based on EPD: Focus on investing in companies with high and sustainable EPDs.

- Monitoring Performance Regularly: Track the EPD and its underlying drivers for each investment to identify potential issues or opportunities.

- Rebalancing the Portfolio: Use EPD K1 insights to rebalance the portfolio, potentially selling investments with declining EPDs and reinvesting in those with strong and improving EPDs.

Practical Applications and Case Studies

The true value of EPD K1 is revealed through its practical application. Consider these examples:

- Due Diligence: Using EPD K1 to assess the profitability of a target company during the due diligence process can uncover hidden risks and opportunities.

- Performance Measurement: Tracking EPD over time provides a more accurate measure of investment performance than traditional metrics.

- Identifying Turnaround Opportunities: Analyzing the EPD of underperforming companies can help identify the root causes of the problems and develop targeted improvement strategies.

(Note: Specific case studies require real-world data and are beyond the scope of this general article. However, including links to relevant case studies from reputable sources would further enhance the value.)

Mastering EPD K1: Strategies for Success

To truly master EPD K1, consider these strategies:

- Invest in Education: Attend workshops, take online courses, and read industry publications to deepen your understanding.

- Practice, Practice, Practice: Apply EPD K1 to real-world scenarios, such as analyzing financial statements or evaluating investment opportunities.

- Network with Experts: Connect with other finance professionals who use EPD K1 to learn from their experiences and share insights.

- Stay Updated: The financial landscape is constantly changing, so stay informed about the latest developments in EPD K1 methodologies and best practices.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about EPD K1:

1. What is the difference between EPD and traditional financial metrics like IRR?

EPD focuses on measuring the economic profit generated by an investment, considering both the return on capital and the cost of capital. IRR, on the other hand, focuses solely on the rate of return. EPD provides a more comprehensive view of value creation.

2. How can I use EPD K1 to improve my investment decisions?

By analyzing the EPD and its underlying drivers, you can identify the key factors that contribute to a company’s profitability and make more informed decisions about which investments to pursue.

3. What are the limitations of EPD K1?

EPD K1 relies on accurate financial data and requires careful analysis. It is also a forward-looking metric, and its accuracy depends on the assumptions used in the calculations. It’s important to remember that no single metric can tell the whole story.

4. Is EPD K1 suitable for all types of investments?

While EPD K1 is particularly valuable for private equity and venture capital investments, it can be applied to a wide range of investments, including public equities and real estate, with appropriate adjustments.

5. How do I get started with EPD K1?

Start by learning the basic formula and understanding its components. Then, practice applying it to real-world scenarios. Numerous online resources and educational materials are available to help you develop your skills.

Conclusion: Embracing the Power of EPD K1

Mastering EPD K1 goes far beyond the basics. By understanding its advanced concepts, applying it strategically, and continuously refining your skills, you can unlock its full potential and gain a significant advantage in the world of finance and investment. From due diligence and portfolio optimization to strategic planning and performance measurement, EPD K1 is a powerful tool that can help you make smarter decisions, drive better results, and ultimately, achieve greater financial success. Embrace the journey of learning and exploration; the rewards are well worth the effort.